• It is actually the law in Florida for all insurance companies to offer hurricane deductibles. These deductibles must be $500, 2%, 5%, or 10% of the home’s value (with some exceptions–ask your insurance provider). You will only have to pay this deductible annually per season—not for every storm that pops up (thank goodness).

•The legal definition of “hurricane coverage” in Florida actually only refers to “windstorm damage” sustained during a hurricane. For example, if your roof is damaged by high winds during a hurricane, you’re covered. If it is damaged badly enough that rain reaches the interior and causes damage, that’s covered too.

• Hurricane coverage in Florida does not cover flooding, which can occur from heavy rainfall or storm surge. You will need a separate flood insurance policy.

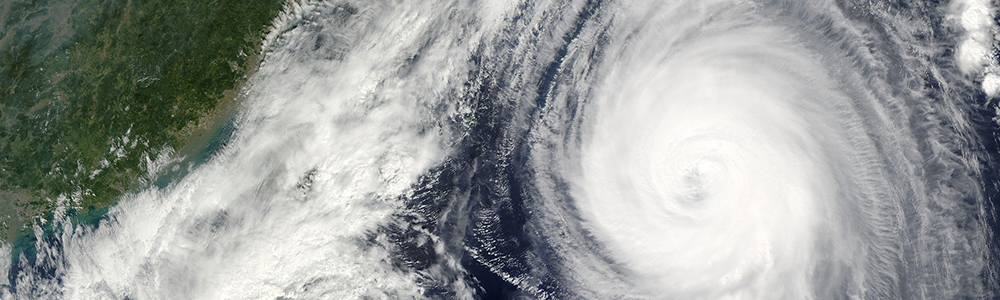

• So when does your policy actually apply? Florida law is highly specific. Your policy will be effective only in the event of a named hurricane declared by the National Hurricane Center. Tropical depressions and tropical storms don’t count. It will be in effect from the time the first hurricane watch or warning is issued anywhere in the state until 72 hours after the last hurricane watch or warning expires.

Our team at Showcase are the home insurance experts, especially when it comes to Florida “specialties” like hurricanes, floods, and sinkholes. Contact us with any of your questions or concerns about how to keep your home storm-proof—financially and physically! We’re always here to help you love where you live.