What Is Prequalification?

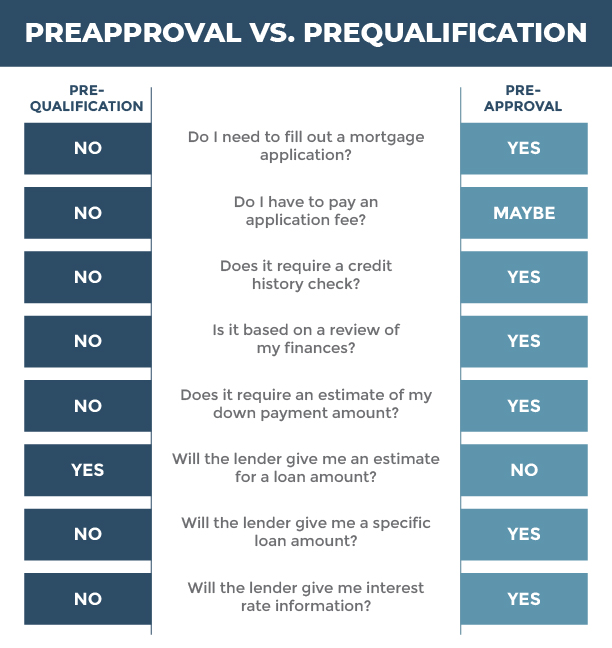

Mortgage prequalification is often the first step in the home-buying process. It can happen well before you even start looking at properties! Prequalification is where a lender gives you a rough estimate of what you will likely qualify for given your current financial situation.

There are typically little to no costs involved in prequalification because it’s not a formal application of a mortgage. Since there’s no credit check involved, lenders aren’t able to guarantee that you’ll be approved and can take out a mortgage for that amount.

But if you’re wondering how much you can get preapproved for, prequalification can give you a better idea of how much you’ll realistically be able to afford when searching for a new home. It also gives home sellers some reassurance that it’s unlikely that you’ll be turned down for a mortgage and not be able to complete the sale once you find the right property.

How Do You Get Prequalified?

Since prequalification is based on information that you’re voluntarily providing to a lender, almost anyone can get prequalified. Typically, you’ll provide a lender with details about your current employment and salary (or an offer letter if you’re relocating for a new job).

You will also need to hand over information about any assets or liabilities that you currently have like student loan debts or existing properties with mortgages to assess your debt-to-income ratio. Once the lender has all of your information, they’ll usually get back to you with a letter of prequalification within several days.

Remember though, prequalification is simply an estimate and isn’t a guarantee of a loan. Once you’re ready to move ahead with actually taking out a mortgage and purchasing a property, you’ll need to be preapproved by your lender.

What Is Preappoval?

Preapproval is the next step or can be the first step if you bypass prequalification and go straight into a mortgage application. It’s a much more involved and detailed process, with lenders completing both background and credit checks in order to determine how much they are willing to lend you. Preapproval can also give you a good idea of what your mortgage interest rate will be as you can often lock in that rate if you move forward within a set amount of time.

There are often application fees involved in preapproval, but they can help to put you in a better position above other interested buyers when making offers on homes. When it comes down to preapproval vs. prequalification, a seller will more than likely choose the person who is most likely to actually receive money from a lender. In a competitive market, preapproval can be a significant advantage.

How To Get Preapproved

Since this is a more formal part of the mortgage process, you’ll need to fill out an official mortgage application with your chosen lender. You’ll need to supply in-depth financial information for the lender to get a full picture of your financial history and current situation.

Your lender will also ask for an estimate of your down payment at this point and you’ll pay several hundred dollars in application fees, so be sure to account for both of these when budgeting for your buying and moving costs.

When To Get Preapproved

You might be thinking “how long does preapproval for a mortgage last?” This all comes down to your specific lender, but the average preapproval is valid for around 90 days in Florida. Your financial situation or the market could change, so banks aren’t willing to commit to an endless amount of time at that amount or interest rate. You can always make adjustments if your situation changes by contacting your bank or prospective lender.

With all that said, you’re now likely wondering when to get preapproved for a mortgage. The ideal time is when you’re already in the house-hunting process and feel like you’re ready to make a purchase.

If you want to be extra prepared, start gathering all of your documentation like W2s, bank statements, and employment verifications before you even start looking at properties. Since preapproval can take about a week, it can be helpful to get the ball rolling to help speed up the process once you find your dream home.

Should I Get Prequalified and Preapproved?

When it comes to preapproval vs. prequalification, there’s no right answer for everyone. But generally speaking, having both before you start looking at homes shows realtors and sellers that you’re serious about buying.

Particularly if you’re a first-time homebuyer, receiving a prequalification letter can give you a good idea of the amount that you might be approved for. This can then help you to decide on a budget range when looking at properties, along with gaining a better understanding of how much you may need as a down payment or to save for moving costs once all finances are taken into account. Yes, it’s an extra step along the way, but it can save you the time and heartache that comes with falling in love with a property that’s far beyond your budget.

If you’re struggling to get prequalified or preapproved, this can also help you to identify red flags for lenders that you need to address. A poor credit score or lack of financial stability are the most common reasons to be turned down for a mortgage. Applying for prequalification can help to stop you in your tracks before you spend money on a mortgage application that you’ll ultimately have rejected.

Preapproval vs. Mortgage Application

Even though preapproval is part of your mortgage application, this is still not a final guarantee that your mortgage will be approved. If you don’t find a home within 90 days of your preapproval, you’ll need to start the process again. You will also need to formally apply for your mortgage once an offer has been accepted on the home you’ve chosen.

Your credit score will then be checked again, even if you’re still within the 90-day preapproval period. In many cases, final approval is contingent on the home inspection and the property meeting the appraisal value. If you’re utilizing a special mortgage like an FHA loan, there are additional considerations that are taken into account before final approval.

But despite these additional steps, having a preapproval in place will certainly help to speed up the process and get you into your new home more quickly.

Start Your Homebuying Process with Showcase Properties

When you’re looking for a property in Marion County or a home in Alachua County, Showcase Properties is here to help. Contact our team of real estate agents if you have any questions or are ready to move ahead with the home buying journey. Whether you’re looking for pool homes, properties with acreage, luxury homes, or even an Ocala horse farm, Showcase Properties can help you to find your next home.