You’ve just received the job offer of a lifetime – which means you are going to have to move to the other side of the country. Or perhaps there’s been a family emergency and you’re planning to move back home to take care of mom or dad. Ultimately, you know you need to sell your home quickly and get the best possible price, but where do you begin?

First things first, you will likely want to call a real estate professional. While it is possible to sell a home yourself, a real estate transaction is a time-consuming and complicated process that, if not managed properly, could end up costing you money. (See 3 Reasons Why For Sale By Owner Isn’t A Great Idea)

A real estate transaction is a complicated process that, if not managed properly, could end up costing you both time and money. That’s not to say it’s not possible to sell your home yourself– it absolutely is an option! But REALTORS® are great partners that help manage the entire process from start to finish, working on your behalf to get you the best deal with the right buyer.

A real estate transaction is a complicated process that, if not managed properly, could end up costing you both time and money. That’s not to say it’s not possible to sell your home yourself– it absolutely is an option! But REALTORS® are great partners that help manage the entire process from start to finish, working on your behalf to get you the best deal with the right buyer.Comparative Market Analysis

One valuable tool in an agent’s price-setting arsenal is the Comparative Market Analysis, also called a CMA. The CMA is an estimate of a home’s value that assists sellers in setting a listing price and helps buyers make competitive offers. A CMA compares a property to other homes in the area that are similar in size and features. Ideally, a CMA uses recently sold homes from the same neighborhood to form a comparison. It is sometimes difficult to find recently sold homes in a rural area or in a slow real estate market– In those cases it might be better to use a formal appraisal to assist with determining a price.

One valuable tool in an agent’s price-setting arsenal is the Comparative Market Analysis, also called a CMA. The CMA is an estimate of a home’s value that assists sellers in setting a listing price and helps buyers make competitive offers. A CMA compares a property to other homes in the area that are similar in size and features. Ideally, a CMA uses recently sold homes from the same neighborhood to form a comparison. It is sometimes difficult to find recently sold homes in a rural area or in a slow real estate market– In those cases it might be better to use a formal appraisal to assist with determining a price.What’s in a CMA Report?

While there’s no standardized CMA report, it will usually include:

• The property’s address and between three and five comparable properties, also known as “comps”.

• A thorough description of each property that includes key features such as elevation, floor plans, and how many bedrooms and bathrooms.

• Each property’s square footage.

• The sales price of each.

• Dollar adjustments for differences between the properties.

• The adjusted sold price per square foot of each.

• The subject property’s fair market value.

For more information, see The Essential Seller’s Guide to Comparative Market Analysis.

BPO and Appraisals

What is a BPO?

A broker price opinion, otherwise known as a BPO, is a less expensive and less involved way to determine the value of a property. A BPO may be used in place of an appraisal for mortgage related transactions like foreclosures or short sales.

The level of detail may differ between broker price opinions. In some instances, the broker will precisely evaluate the interior and exterior of a home. In other instances, the broker will merely drive by a home and estimate the value from the exterior.

• Details about the home’s location, building type, and size.

• An overview of the local housing market and the current trends.

• Detailed information about the home and its condition.

• An analysis of at least three comparable homes within the area that have recently sold and another three homes that are currently for sale.

• Information regarding the number of foreclosures in the neighborhood.

How is an Appraisal Different?

A home appraisal is an exceedingly regulated, honest estimate of a home’s value administered by a licensed real estate appraiser. Appraisals are typically required as part of the homebuying process.

An appraiser collects details and information about the home in addition to information about homes that have recently been sold. The appraisal report allows mortgage lenders to determine if the purchase price is reasonable and calculates a borrower’s loan-to-value ratio.

Appraisals can typically be expected to cost several hundred dollars, but final numbers can be confirmed by your appraiser. BPOs typically cost less than half of the amount of an appraisal. (Read more about the appraisal process.)

Other Things to Consider

A Seller’s Market vs. A Buyer’s Market

As of late, we’ve seen a steady seller’s market here in Central Florida, which can make it more difficult to establish a reasonable listing price when buyers are willing to pay more in a competitive market.

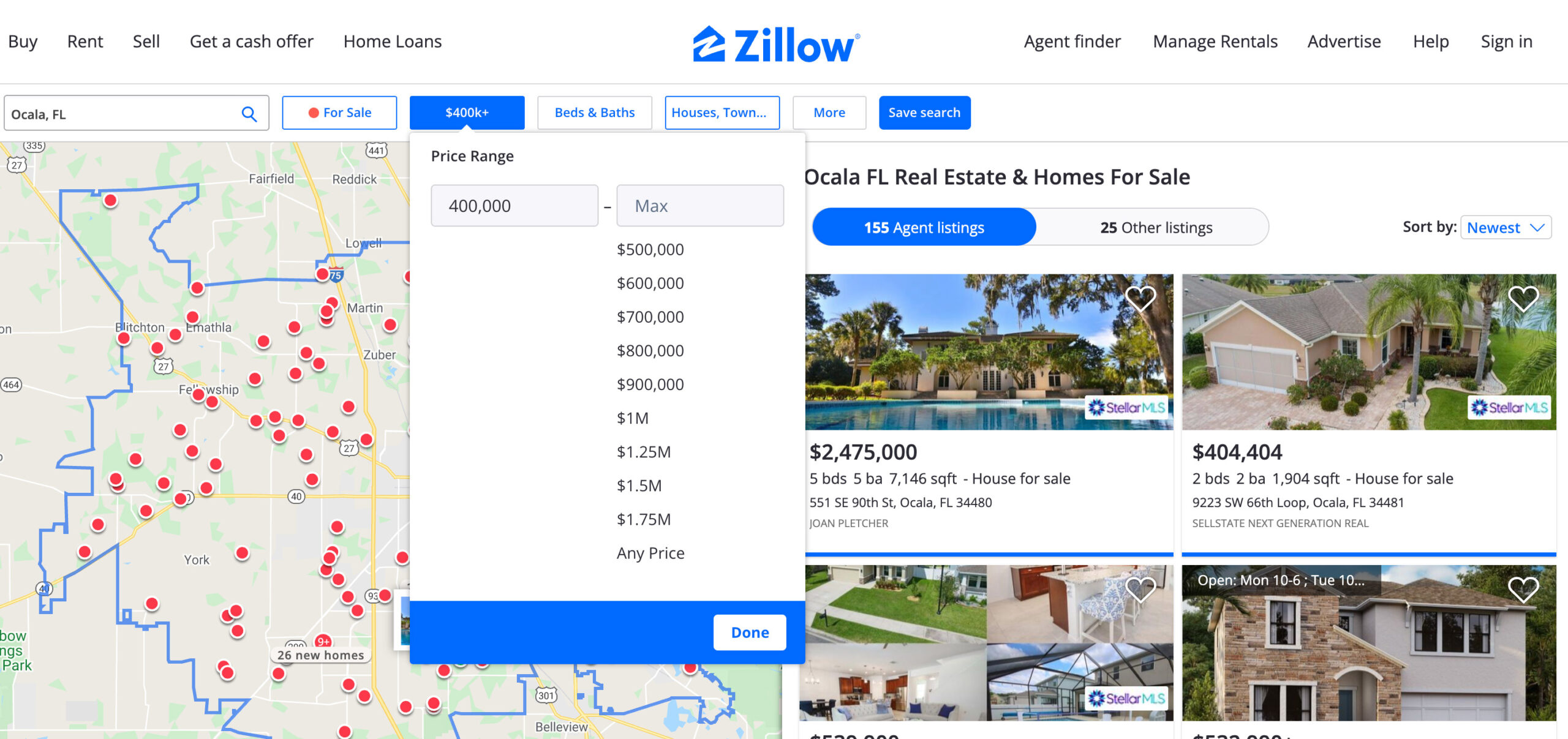

Online Pricing Benchmarks

Ultimately, the Seller Sets the Price

There are also some things a seller can do to ensure a quicker sale at a higher listing price. For example, it pays to make minor cosmetic changes to improve the way a home shows. This could be as simple as decluttering and putting away personal photos, repainting the interiors with a fresh neutral shade, or even replacing old carpet with new flooring.

“They know if they have a mortgage, what their balance is, what they need to take home when they sell. Can they afford to go buy another place? What do they need to walk away with? I never ask what their bottom line is, because they have to make that decision.”

— Valerie Dailey, Owner/Broker Showcase Properties

The Right Price = Success

If you are ready to sell your home or buy another home, we would love to offer our assistance. The agents at Showcase Ocala and Gainesville are experienced with the ins and outs of the local markets and ready to help you get started, whether it’s commercial properties, residential listings, horse farms, or luxury homes with acreage. Contact us today!

Check out our recent blog for more tips on selling your home.